Gambar Pelbagai Acara Oleh ICM.com

What Is A Yield Curve Inversion?

Aug 16, 2019

The yield curve inversion has been in the spotlight for quite a while, analysts have been going bonkers over the last bits of data that have left Wall Street trembling and shaking to the core. Not everyone is an economy expert, otherwise things might either be all too well or just catastrophic. Anyways, whenever you see these three little words, expect some big changes and maybe a stumbling economic situation.

The yield curve inversion has been in the spotlight for quite a while, analysts have been going bonkers over the last bits of data that have left Wall Street trembling and shaking to the core. Not everyone is an economy expert, otherwise things might either be all too well or just catastrophic. Anyways, whenever you see these three little words, expect some big changes and maybe a stumbling economic situation.

So, what does the yield curve mean?

The yield curve is simply the measure of all yield bonds over a long period of time. The X axis (or horizontal line) shows the time when these bonds will be repaid and is usually set in years, months, or even decades, while the Y axis (the vertical line) measure the interest that bondholders collect on a yearly basis. Normally the yield curve is supposed to go up, steadily, hence showing signs of economic expansion with long-term bonds providing higher yields than their shorter term counterparts. The way the curve bends assists economists in predicting the health of the economy.

Sometimes this curve gets inverted and there are only two causes for this. The first is the Fed or Federal Reserve; the United States of America’s central bank, which influences all short-term bonds (these are usually on the left side of the curve). When the economy is expanding, the Fed raises interest rates to limit borrowing, hence warding off inflation, which can get out of hand if economic growth is too quick. The exact opposite takes place when stagnation hits the economy – remember the interest-rate issue and the whole shenanigan between Trump and Fed?

Key takeaways here:

Who controls the right side of the chart?

INVESTOR SENTIMENT.

When investors perceive economic growth, they take money out long-term bonds and invest in riskier assets (see stocks for instance). With lower demand, bond prices plunge, pushing yields up (price of a bond is inversely related to the yield). But when investors predict a rocky road ahead, the move into safer assets, and pour their money into long-term bonds, which pushes yields down and bond prices up, which is what exactly happened beginning of 2019. With yields falling and short-term interest rates going up, the curve can invert, this is a very bad omen for investors.

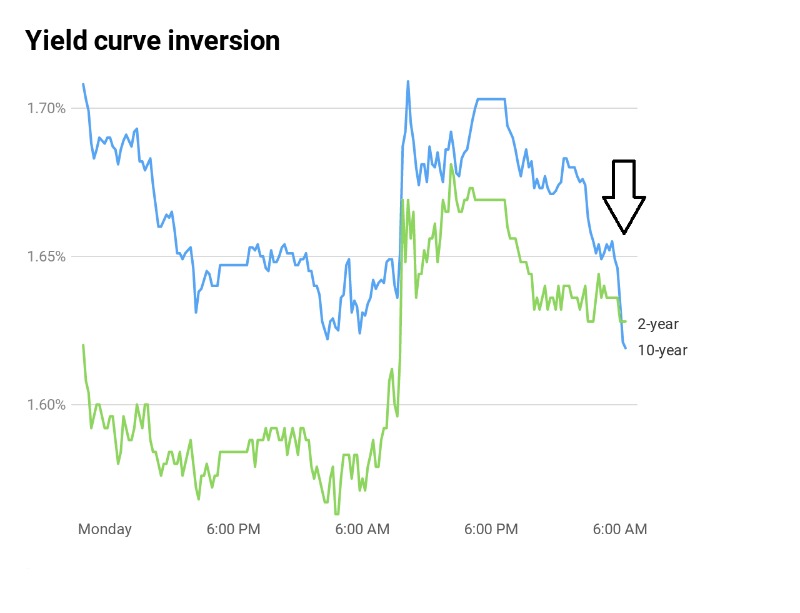

Just like ancient times, bad omens ought to be taken as seriously as possible, a flashback to those olden societies, omens were divided into two parts, the “protasis” and the “apodosis;” two parts of the same puzzle. The protasis is the hypothesis and observation, while the apodosis is the outcome or results of this observation. Let’s take the yield curve inversion and make an observation or protasis – please see the chart below:

Blue line – 10 year bond yields

Green line – 2 year bond yields

Notice how the yellow line that started way above the purple line, had suddenly dipped below? Well that’s the bad sign, it’s something that all analysis platforms and economy experts have set as THE mark for a looming recession. Yes! It is scary and history is witness to the effects of yield curve inversion, which have set the world in a state of stagnation 11.4 months (on average) following the inversion.

Notice how the yellow line that started way above the purple line, had suddenly dipped below? Well that’s the bad sign, it’s something that all analysis platforms and economy experts have set as THE mark for a looming recession. Yes! It is scary and history is witness to the effects of yield curve inversion, which have set the world in a state of stagnation 11.4 months (on average) following the inversion.

| Yield Curve Inversion Date | Start of Recession | Lead (months) |

|---|---|---|

| June 1973 | November 1973 | 5 |

| November 1978 | January 1980 | 14 |

| October 1980 | July 1981 | 9 |

| June 1989 | July 1990 | 13 |

| August 2006 | December 2007 | 16 |

In short, every time the curve dips below zero, a recession follows and that’s your apodosis!

It is not time to brace ourselves for what is yet to come; no one will ever know when things might hit the wall but, as they say, it ain’t all over until the fat lady sings!

Stay tuned!

ICM Capital Limited (UK) dikawal selia dan diberi kuasa oleh nombor pendaftaran Financial Conduct Authority (FCA): 520965.

ICM Capital Limited (UK) dikawal selia dan diberi kuasa oleh nombor pendaftaran Financial Conduct Authority (FCA): 520965. ICM Limited (Abu Dhabi, UAE) dikawalselia dan diberi kuasa oleh Lembaga Kawal Selia Perkhidmatan Kewangan (FSRA) Abu Dhabi Global Markets (ADGM) nombor pendaftaran: 210045.

ICM Limited (Abu Dhabi, UAE) dikawalselia dan diberi kuasa oleh Lembaga Kawal Selia Perkhidmatan Kewangan (FSRA) Abu Dhabi Global Markets (ADGM) nombor pendaftaran: 210045. ICM Capital Limited (MU) dikawal selia dan diberi kuasa di bawah nombor lesen: C118023357.

ICM Capital Limited (MU) dikawal selia dan diberi kuasa di bawah nombor lesen: C118023357. ICM Capital Limited (SC), dikawal dan diberi kuasa oleh Financial Services Authority (FSA) Seychelles di bawah nombor lesen: SD201.

ICM Capital Limited (SC), dikawal dan diberi kuasa oleh Financial Services Authority (FSA) Seychelles di bawah nombor lesen: SD201. ICM Capital LLC (VC) didaftarkan oleh Financial Services Authority of Saint Vincent and the Grenadines di bawah nombor: 1853 LLC 2022.

ICM Capital LLC (VC) didaftarkan oleh Financial Services Authority of Saint Vincent and the Grenadines di bawah nombor: 1853 LLC 2022. ICM Capital SA (Pty) Ltd ialah Pembekal Perkhidmatan Kewangan berlesen, dikawal selia dan diberi kuasa oleh Financial Sector Conduct Authority (FSCA) Afrika Selatan FSP: 53234.

ICM Capital SA (Pty) Ltd ialah Pembekal Perkhidmatan Kewangan berlesen, dikawal selia dan diberi kuasa oleh Financial Sector Conduct Authority (FSCA) Afrika Selatan FSP: 53234. ICM House AG (Zurich, Switzerland) ialah ahli ARIF (Association Romande des Intermediaries Financiers) di bawah nombor pendaftaran CHE 497.911.976.

ICM House AG (Zurich, Switzerland) ialah ahli ARIF (Association Romande des Intermediaries Financiers) di bawah nombor pendaftaran CHE 497.911.976.